Export Receivables Financing Program

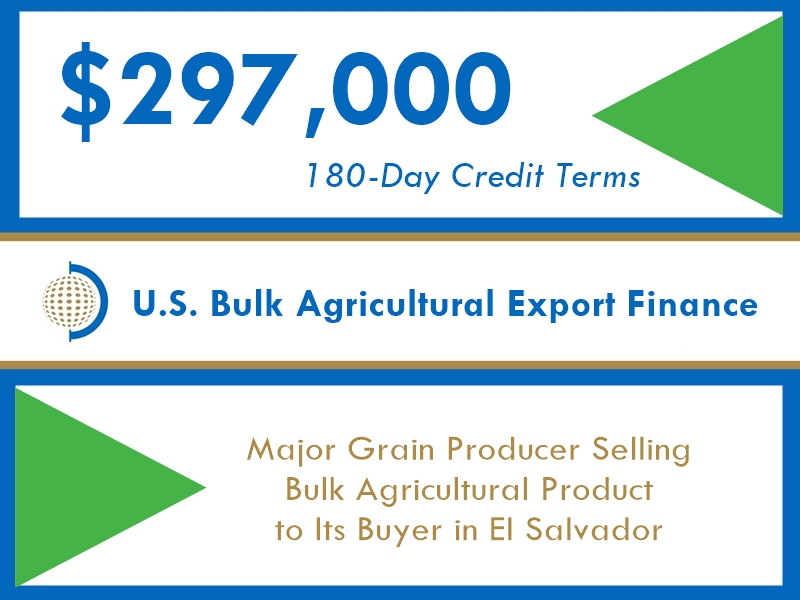

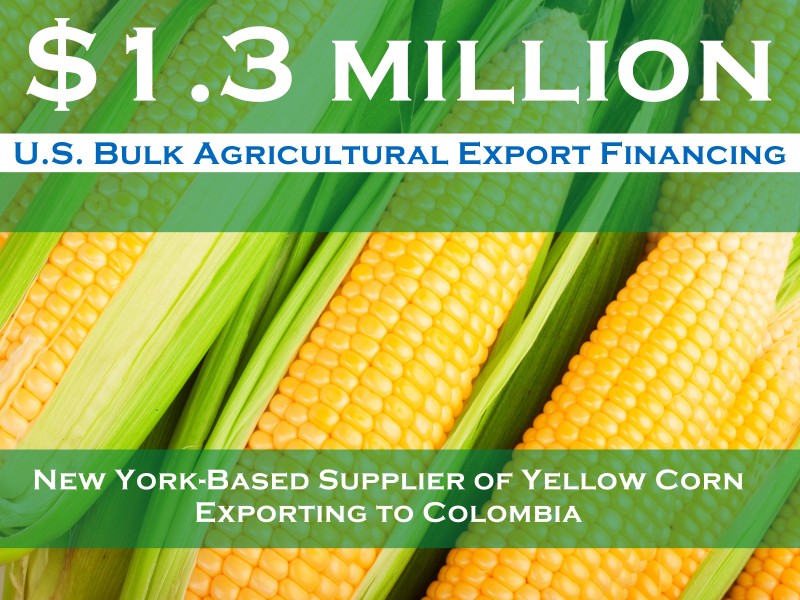

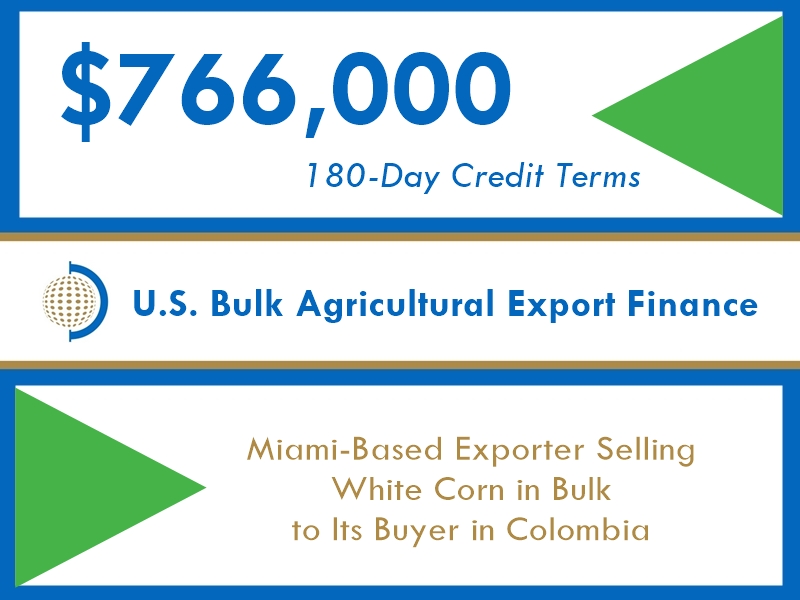

Increasingly, United States exporters with credit-worthy international customers are using this export receivable financing program in order to obtain cash and liquidity upon shipment when extending credit terms to international customers 윈도우 putty 다운로드. While Drake Finance pays United States exporters up to 90% of the invoice total upon shipment, the foreign buyer is extended open account payment terms of up to 180 days.

Our export receivable financing program is perfect for United States manufacturers, exporters and distributors of products made in the United States. This program helps United States exporters meet two critical needs:

- Protection against foreign buyer nonpayment

- Immediate access to working capital

Drake Finance & the Export-Import Bank of the United States

Drake Finance is able to offer United States exporters export receivable financing when its foreign receivables are insured through the Export-Import Bank of the United States (Exim Bank), the official export credit agency of the United States Excel Inventory Management.

Exim Bank is not really a bank nor does it compete with private sector lenders. Rather, Exim Bank provides export financing products (export credit insurance and guarantees) that enable lenders like us to provide United States exporters with the financing they need to effectively compete in the global market.

Our staff is available to guide you through the process of obtaining export credit insurance from Exim Bank. All it takes is 30 minutes of your time and in a couple of weeks, you’ll have a policy in place that will allow us to finance your United States export sales Download documents videos.

Call (305) 854-0101 to schedule your appointment today or submit your online inquiry here and we’ll be in touch within 1 business day.

How Export Finance Works

1. The United States exporter presents Drake Finance with a copy of the following:

- Purchase Order from international customer to U.S. exporter

- Invoice issued to international customer from U.S. exporter

- Bill of Lading evidencing export shipment from transport company

- Proof of export credit insurance premium payment from U.S mp3 to you shining today. exporter

Upon approval, Drake Finance will advance up to 90% of the United States exporter’s invoice to its international customer within 48 hours.

2. Once the international customer pays Drake Finance the invoice in full, we remit the remaining 10% minus our fees back to the United States exporter. It’s that simple!

Recap: The United States exporter was able to receive up to 90% of its payment for its export sale within 48 hours of Drake Finance processing its shipment documents movie Elephant. Meanwhile, its international customer was able to pay for its purchase over time.

Helpful Guides for United States Exporters

- A Guide to Export Finance for United States Exporters illustrates how Drake Finance has streamlined the financing process to make it easy for United States exporters to make the most out of every export sale. Our video also highlights a few of the many advantages of using an export financing program, like ours.

Ahora en Español: Guía para la financiación de las exportaciónes

- A Guide to Shipment Documents for United States Exporters helps United States exporters understand what’s required of them in order for us to deliver the fastest possible turnaround time with disbursement requests.

To download your copy, please click here heat.

Getting Started is Easy!

Take a moment to fill out our online application and we’ll get back to you within 1 business day. United States exporters are encouraged to submit the last 2 years of company-prepared financial statements to rlopez@drakefinance.com for immediate consideration. Approval for this program averages 15 days.

Contact us for more information or call (305) 854-0101 to speak with our Managing Principal and Board-Certified International Lawyer, Richard H 네버싱크 다운로드. Lopez, Esq. directly.

Applying with Drake is Fast, Free, and Simple!