Want to increase your international sales of capital equipment if tomorrow is clear?

Drake Finance Makes Your International Trade Finance Possible

Who we are: We are a private international trade finance lender that works directly with Ex-Im Bank by helping U.S exporters expand into international markets Download Dawn Road.

What we do: Our international trade financing programs minimizes non-payment risk, give exporters liquidity and allow foreign buyers to purchase goods on reasonable credit terms, allowing you to stay competitive and build more business relationships Arduino Mini Download.

Why Choose Us 시황제 암살 다운로드? It’s Simple!

Quick turnaround time, Low rates, no hidden fees, and second to none client service 톰캣 6 다운로드.

Non-Bank Lender

Drake is a non-bank lender, giving us the ability to have a simpler application process and increased turnaround time to get your trade financing in place pupils. We make a complex process easy for you so that you can focus on your business.

Exceptional Client Service

Drake provides stellar client service mario games. Our client-centric approach to solving your trade finance issues together with our quick turnaround time and responsiveness sets us apart from our competitors Green Sea. Many of our clients have been with us for years.

We Hold Your Hand

Whether you are a new or seasoned exporter or manufacturer selling oversees, Drake will help you navigate through the entire process from beginning to end 자바 1.7 다운로드. As a private non-bank lender, we can approve trade finance loans much faster than traditional banks.

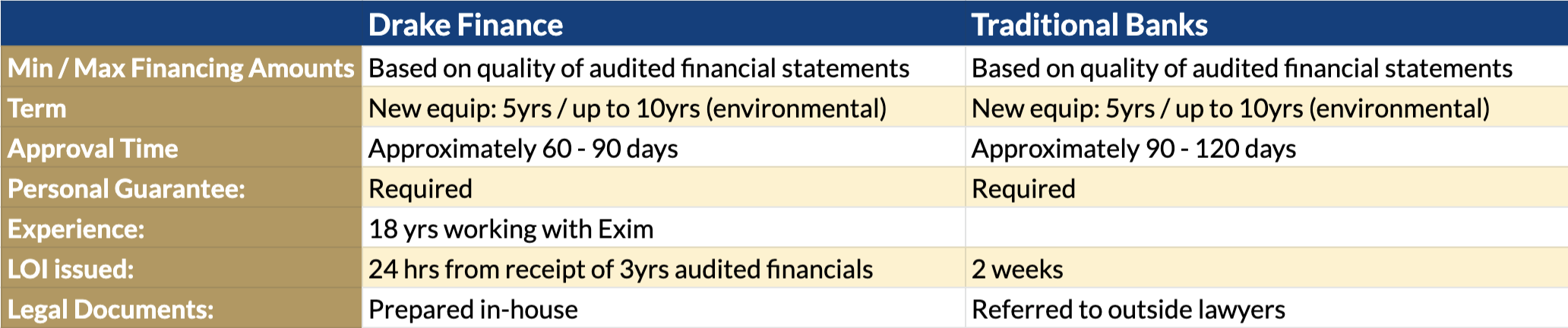

Compare Us to Traditional Banks

For example, here are some differences between Drake Finance and a traditional bank when it involves international account receivables financing.

Ready for new financing?

Do you want to grow and become competitive in overseas markets?

Ready for New Financing?